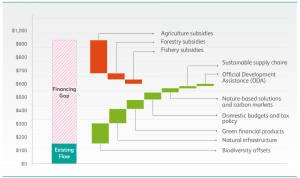

Around half of the biodiversity financing gap could be closed with no new investment. Much of what we need is better deployment of existing funds and smarter policy and investment choices—shifting the flow of capital away from harmful subsidies and investments that degrade biodiversity towards positive outcomes that will benefit biodiversity. Other recommendations work by getting more bang for the buck out of what we already spend.

The report groups recommended approaches into three categories: those that reduce harm, those that generate new revenue, and those that generate increased benefits by making different use of existing funds.

Reduce Harmful Financial Flows

Reducing capital flows that harm biodiversity, in turn, reduces the need for funding to counteract these impacts. Changes in the way various sectors operate—and the operations that governments subsidize—can go a long way toward closing the biodiversity financing gap.

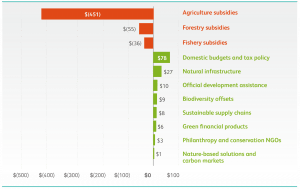

Reform Harmful Subsidies – Subsidy reform represents the single most significant opportunity to close the financing gap. Between US$ 273 – 542 billion per year spent is currently spent on agricultural, fisheries, and forestry subsidies that are potentially harmful to biodiversity. Redirecting those payments to incentivize more sustainable practices would benefit nature while also mitigating climate change and improving food security.

Improve Investment Risk Management – Actions taken by financial institutions to identify and manage the risks to biodiversity from their investments. These include a number of screening tools and standards that investors are adopting that enable them to review risks and make informed decisions to avoid investments that may have negative impacts on biodiversity, or to invest in areas that have positive biodiversity impacts. Given the enormous scale of global capital markets and the trillions of dollars invested in infrastructure, energy, transportation, extractives, and other damaging projects, the mainstreaming of these biodiversity-related risk management practices in conventional financial markets presents an enormous opportunity to prevent negative impacts to biodiversity.

Green Sustainable Supply Chains – Supply chain sustainability relates to the management of environmental, social, and governance aspects of the movement of goods and services along supply chains, from producers to end consumers. The historical impact of global supply chains on biodiversity has been largely negative, driven by land-use change and unsustainable agricultural, forest, fisheries, and other practices associated with commodities. However, a shift toward more responsible supply chain management practices offers an opportunity to avoid harm to biodiversity.

Generate Revenue

Even if we significantly reduce harmful financial flows, we still need new sources of funding. The key is to generate revenue in smart, fair, and equitable ways that promote positive biodiversity outcomes while sharing the financial burdens among those who profit most from biodiversity or can better afford it. Revenue generating mechanisms include:

Reform Domestic Budgets and Tax Policy – Governmental budgets are currently the main source of financing for biodiversity conservation, representing 55–61% of total funding recorded and presented in this report. However, while prioritizing government budget expenditure for biodiversity, raising revenue from taxation may be insufficient to close the biodiversity financing gap. This report describes several categories of special taxes, fees, levies, and other innovative fiscal measures that both national and subnational governments can impose to either increase revenue to fund biodiversity protection or to incentivize or disincentivize activities that either benefit or degrade biodiversity.

Scale Green Financial Products – Investors interest in sustainable and responsible investing has dramatically increased in recent years. This report discusses a range of green financial products that can channel financing toward green investments that produce environmental benefits. Green financial products are a collection of financial instruments, primarily debt and equity, that facilitate the flow of investment capital into companies and projects that have a positive impact on biodiversity. This report discusses the role of green bonds, green loans, and private equity funds in supporting biodiversity. The report also notes emerging and innovative new developments in green finance such as environmental impact bonds, green insurance products, and the growing roles that governments are playing through green banks, finance facilities, and specific efforts to incentivize increased private investment.

Strengthen Biodiversity Offsets Policies– Given the rapid expansion of urban centers and the associated development of infrastructure, biodiversity offsets are a way for biodiversity to receive increased financing and protection. Under an offset policy, any biodiversity lost to development must be compensated for such that there is a net gain or, at least, no net loss of biodiversity. Offsets should be implemented once development projects have done their utmost to avoid and minimize adverse environmental impacts. Currently, 42 countries have biodiversity offset policies in place, but with evidence of enforcement from fewer than 20% of these countries. Estimates for scaling up biodiversity offsets in this report are based on the full implementation of existing policies by these 42 countries plus expanded application of offset policies in countries.

Invest More Wisely

In addition to reducing harmful flows and generating new revenue, there’s the question of how we use existing public and private investments.

Increase Official Development Assistance for Biodiversity – In the context of the Convention on Biological Diversity (CBD), the 2010 Aichi Targets called for a “substantial increase” in resources available from all sources to support the implementation of the convention. In 2012, the Parties adopted a decision calling on donor countries to double foreign aid flows for biodiversity by 2015 relative to 2010 levels, and at least maintain them at that level through 2020. That target has essentially been met by donor countries. The report describes current official development assistance (ODA) spending and suggests that ODA funding to biodiversity-rich countries double again between 2020 and 2030, with the new funding primarily targeted to supporting country efforts to develop other strategies and programs (such as are described in this report) to increase financing and protection of biodiversity.

Invest in Natural Infrastructure – In recent years, urbanization and the resulting increase in demand for resources from cities have elevated the importance of water supply and watershed protection, while the growing risk from extreme weather events and sea-level rise has highlighted the importance of coastal protection. Natural infrastructure funding is almost entirely provided by public entities through grants and contracts for watershed protection, but there are emerging areas that include both public and private sector investment, including user-driven watershed investments, water quality offset trading, and others. Additionally, there is growing evidence that the relative costs of protecting and managing natural water supplies and flood control can be cheaper than traditional engineering approaches.

Maximize the Potential of Nature-based Solutions and Carbon Markets – As countries move toward the development of new programs to support the delivery of their national climate goals (specifically through their Nationally Determined Contributions, or NDCs), there is a growing emphasis on the protection and restoration of forests and other biodiversity-rich ecosystems in what are called Nature-based solutions (NBS). The report describes several pathways countries might take to develop one or more NBS strategies as part of meeting their NDC goals, and it provides estimates of the amount of funding these efforts could generate that will have direct biodiversity benefits. Additionally, a number of countries are developing national (or, in some countries, subnational or jurisdictional) policies that use the pricing of carbon as part of their overall climate strategies.